One platform, unlimited potential

Trusted by

Support to drive your business forward

Equity Management

Venture Capital

A platform as agile as your business

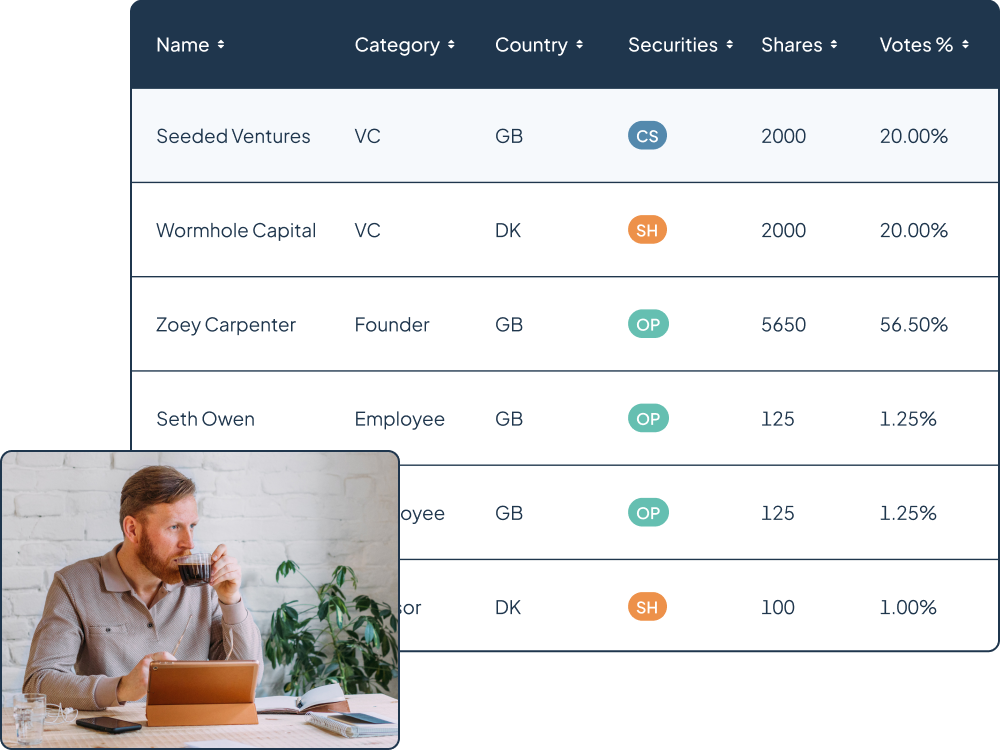

Digital cap table

View fully diluted ownership, track past transactions, model scenarios and administer funding rounds.Company valuations

Get EMI, CSOP, 409A and growth share valuations, performed by in-house experts in 3-5 business days.EMI share plans

Set up your EMI scheme and start issuing options in weeks, using customisable share plan templates designed by lawyers.Special purpose vehicles

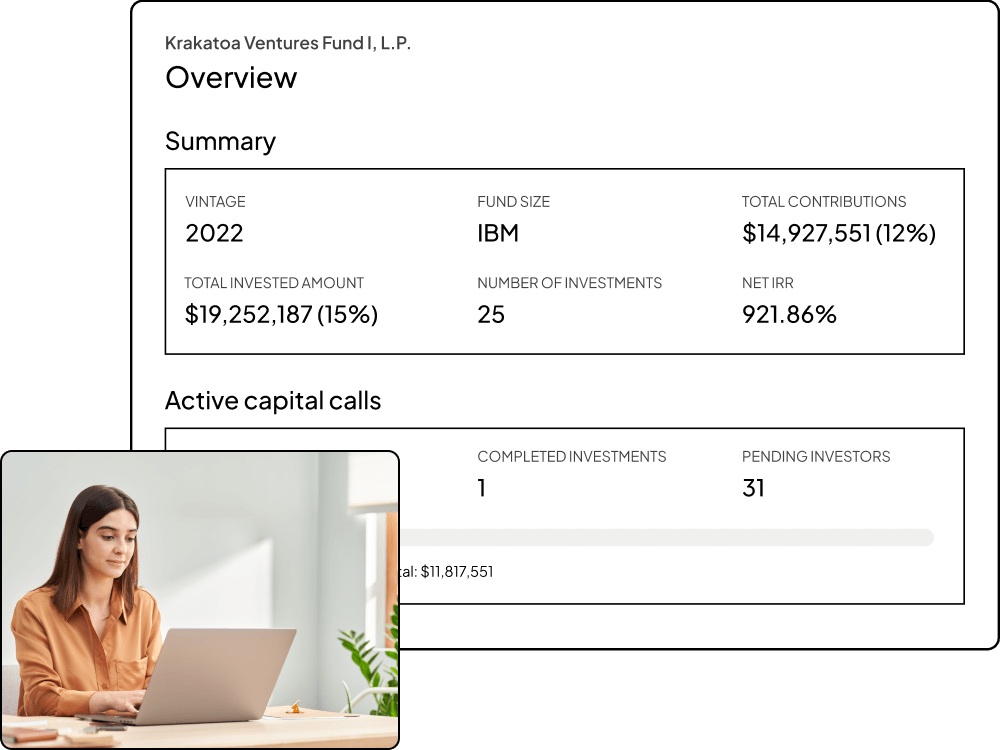

Form, close, and administer your SPV in a few clicks with full support from Carta’s experienced team.Fund admin

Focus on your deals knowing your back office is handled by our software and fund services team.

Supporting owners across the globe

Carta is your international solution with fund and SPV structures across the US, UK and Europe. You can also manage UK, multi-geo and multi-currency share plans with automated filings and unlock 409A valuations for US employees.

We can't wait to see what you build

DISCLOSURE: This communication is on behalf of eShares Inc., dba Carta, Inc. (“Carta”). This communication is not to be construed as legal, financial, accounting or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Features and pricing subject to change. Carta does not assume any liability for reliance on the information provided herein.

Please refer to important disclosures found here.

©2024 eShares, Inc. dba Carta, Inc. All rights reserved.